Case study #1The One Where We Rethink the Payout Experience for Glovo Partners

Creating a flexible, transparent payout system to improve partner retention, reduce operational friction, and unlock new revenue opportunities

About Glovo

Glovo is a multi-sided marketplace that connects couriers, customers, and local businesses for on-demand delivery. Partners rely on the platform as a key revenue stream, making payout speed and transparency essential for day-to-day operations.

Team

Product Manager | Product Designer | Product Researcher | Engineering Manager | 2 Backend Engineers | 2 Frontend Engineer | Finance Analyst | Support Ops | Data Analyst

Problem Summary

Running a restaurant is a daily balancing act, and cash flow plays a critical role in day-to-day operations.

Glovo partners relied on a fixed monthly payout cycle that didn’t match the financial rhythm of their businesses.

This created cash-flow strain, reduced trust, and generated a high volume of support tickets, while competitors were already offering faster access to earnings.

Success metrics

→ Achieve 8% adoption in the MVP rollout

→ Unlock a projected €5.4M yearly revenue opportunity

→ Improve retention among liquidity-sensitive partners

→ Reduce payout-related support tickets

→ Maintain financial and fraud risk within operational limits

High-Level Solution

Introduce a flexible payout option that allows eligible partners to access earnings daily, with transparent fees, clear payout timing, and safeguards to ensure financial and operational stability for Glovo.

Early Validation (POC)

Before entering full discovery, we tested a small proof of concept with a limited group of eligible partners which reached 4% adoption, validating strong demand for faster payouts.

This early signal also allowed us to model a €5.4M/year revenue opportunity, which gave us the confidence to invest in a full discovery-to-MVP initiative together with Product, Engineering, Finance, Risk, and Support.

Research & Discovery

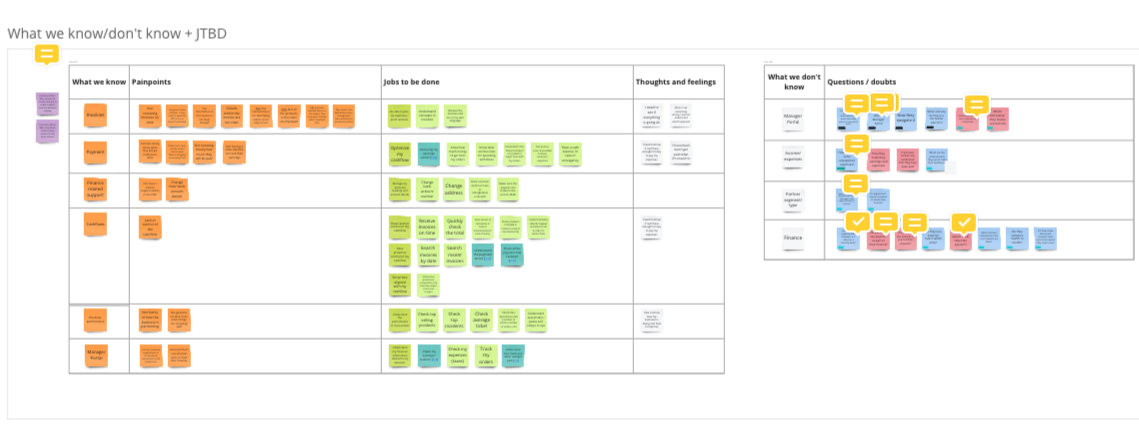

We used a mixed-methods approach to first uncover behaviours and motivations through interviews and shadowing, and then validate patterns at scale with surveys and data analysis. This helped us align qualitative insights with financial, operational, and behavioural realities.

Methods

Interviews with partners across key markets to understand expectations, pain points, and mental models around payouts

Surveys to validate patterns at scale and quantify behaviours, needs, and sensitivity to payout timing

Analysis of payout behaviour and financial patterns to identify liquidity dependencies

Support ticket review to surface recurring problems and areas of friction

Competitive benchmark to understand industry standards in payout speed and transparency

Workshops with Finance and Risk to uncover operational constraints, fraud risks, and feasibility boundaries

Key Insights

Fee sensitivity was a clear signal for adoption, with activation concentrated among partners with higher daily earnings.

Partners valued control and predictability, confirming strong product-market fit.

Liquidity had a direct impact on retention, especially for small-volume partners.

Unlimited payouts introduced financial and fraud risk, requiring eligibility rules.

Each payout carried a real operational cost, so the model had to remain sustainable.

Low clarity and visibility of payout messaging reduced awareness and adoption.

Jobs to Be Done (JTBD)

We reframed insights using JTBD to anchor the problem around control, predictability, and transparency, shaping our direction before moving into solution exploration.

→ “When I earn money through the platform, I want predictable access to those funds so I can manage daily operations confidently.”

→ “When I trigger a payout, I want clear information about timing and fees so I can make the right financial decisions for my business.”

→ “When cash flow is tight, I want the option to access earnings sooner so I can keep my business running smoothly.”

Defining the Problem

Partners relied on a fixed monthly payout cycle that didn’t match their cash-flow needs, creating financial strain and reducing trust. At the same time, the existing model carried operational costs and fraud risks for Glovo.

This created a clear gap between what partners needed (predictable, faster access to earnings) and what the current payout system could support.

How might we offer partners more flexible access to their earnings in a way that is simple, predictable, and sustainable for the business?

Defining the MVP

We explored multiple payout models to balance partner needs with fraud exposure and operational costs. Competitive benchmarking helped refine the feature set and pricing model, while internal system constraints shaped what was feasible for the MVP.

✓ Option 2: Daily Payout

Status: Selected for the MVP

+ Strong alignment with partner needs (control & predictability)

+ Clear PMF validation in early research

+ Monetizable via a small transaction fee (2%)

– Required eligibility rules due to fraud and cash-flow exposure

Option 1: Standard Payout

(30-day cycle)

Status: Kept as default

+ No operational cost

+ Well-established in the system

– Did not address partners’ cash-flow needs

Option 3: Weekly Payouts

Status: Deprioritized

+ Operationally simpler than daily payouts

– Only partially addressed the core JTBD around control

– Low differentiation vs competitors

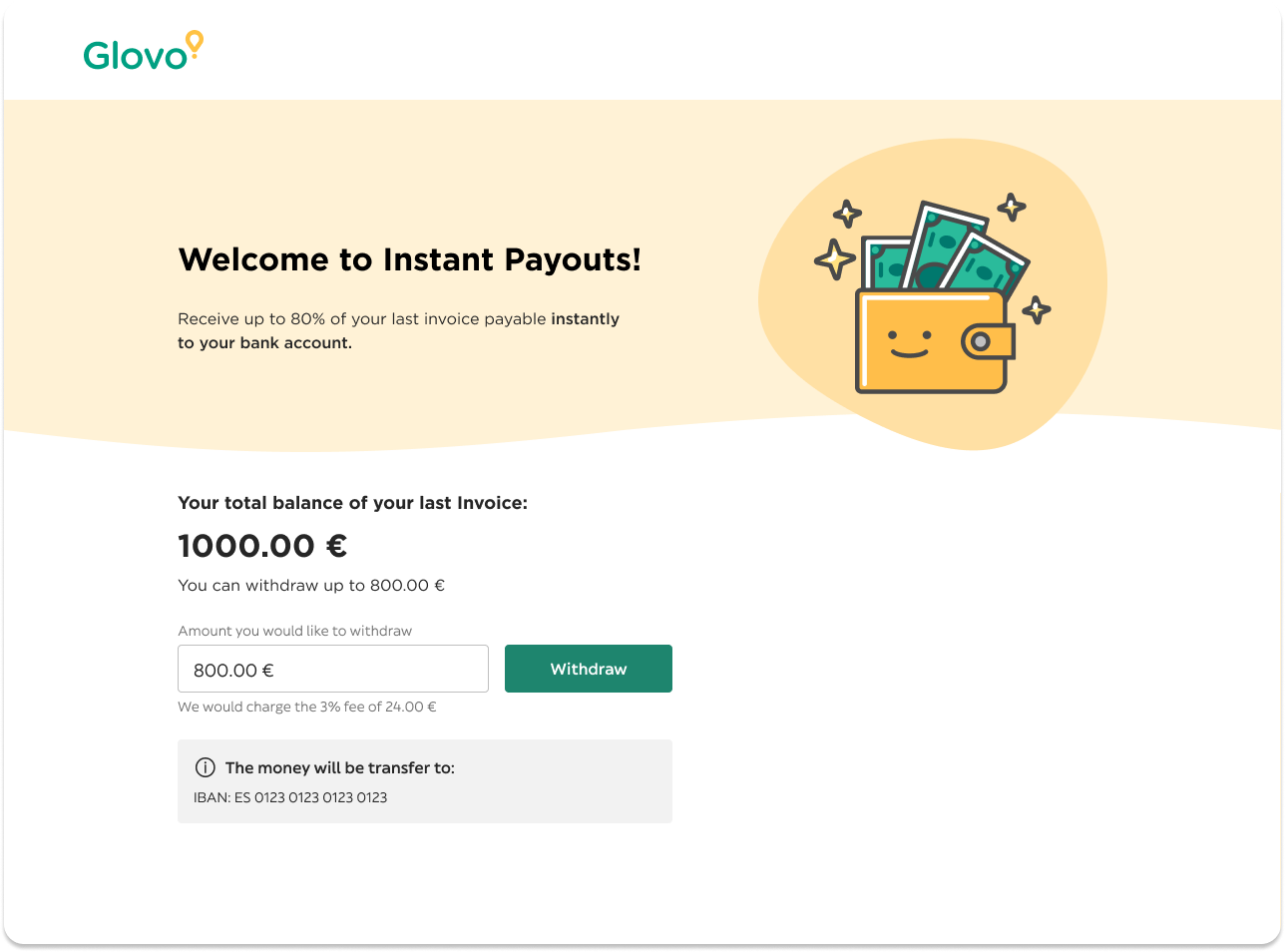

Option 4: On-Demand

(trigger anytime)

Status: Deprioritized

+ Maximum flexibility

– High financial and fraud risk

– Required complex ledger and reconciliation updates

Included

Daily Payout as a new opt-in feature

Clear fee disclosure (2% transaction fee) before requesting a payout

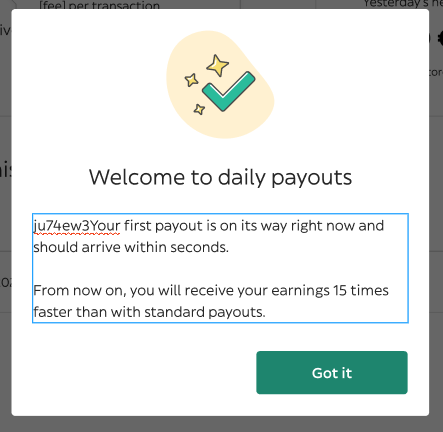

Instant confirmation screen with payout timing and status

Payout History to log past transactions and provide transparency around actions taken

Excluded

Weekly and on-demand payouts were deprioritized due to higher fraud exposure and operational cost, making them better candidates for future iterations.

Support for multi-store partners

Wallet or advanced financial planning features

Multi-currency support

Designing the solution

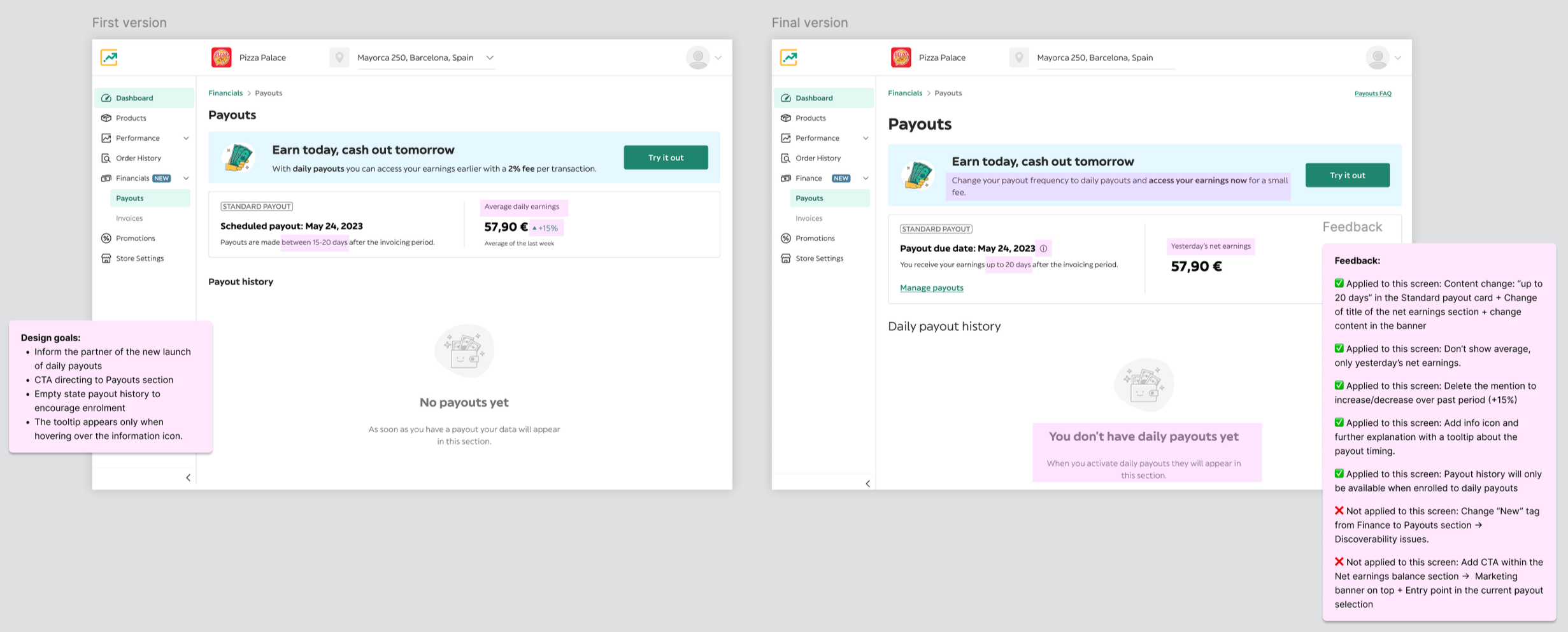

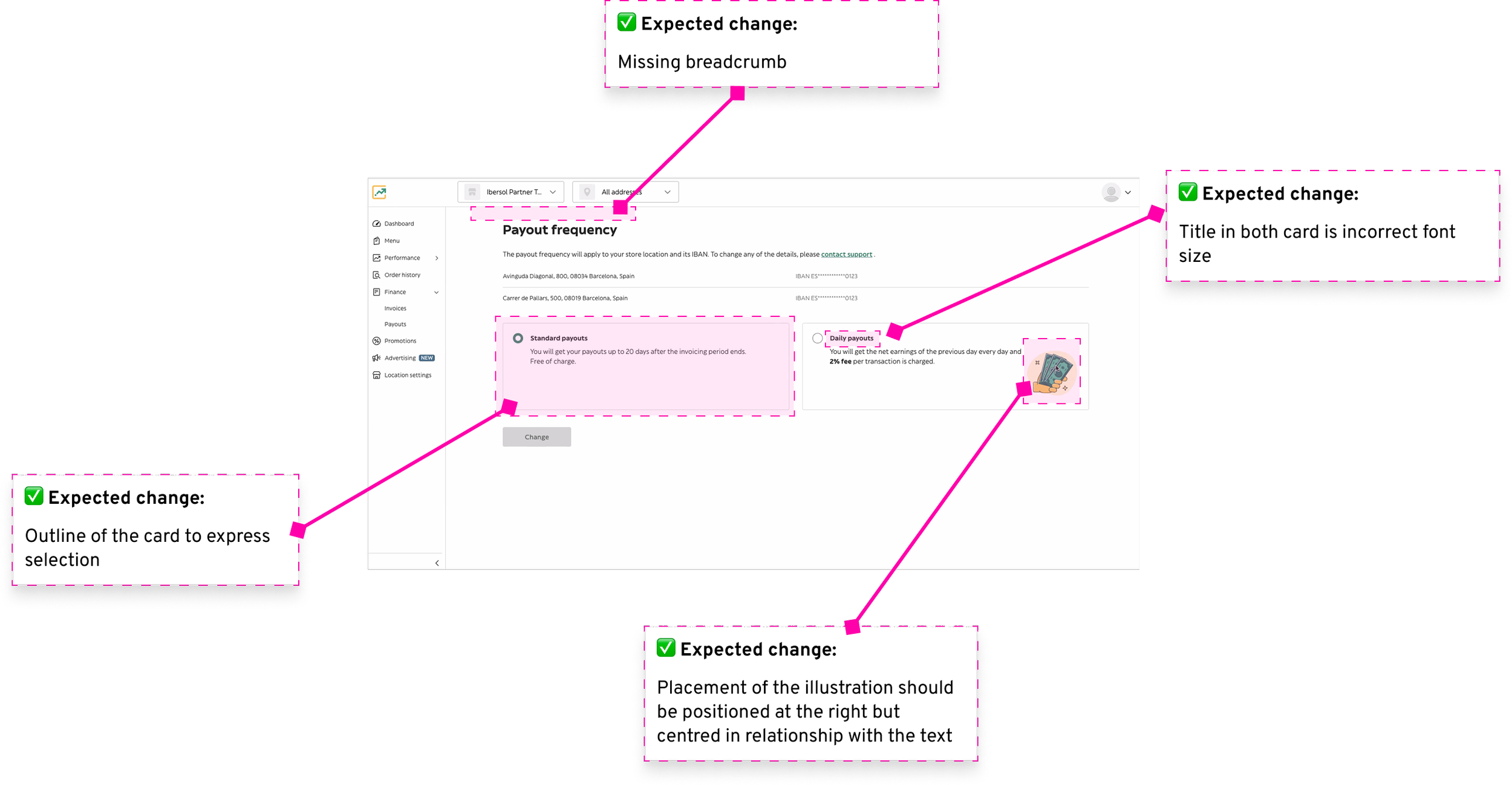

We followed an iterative, cross-functional approach, moving from early low-fidelity exploration to high-fidelity interaction design once the core flow and constraints were validated with Product, Engineering, Finance, and Risk.

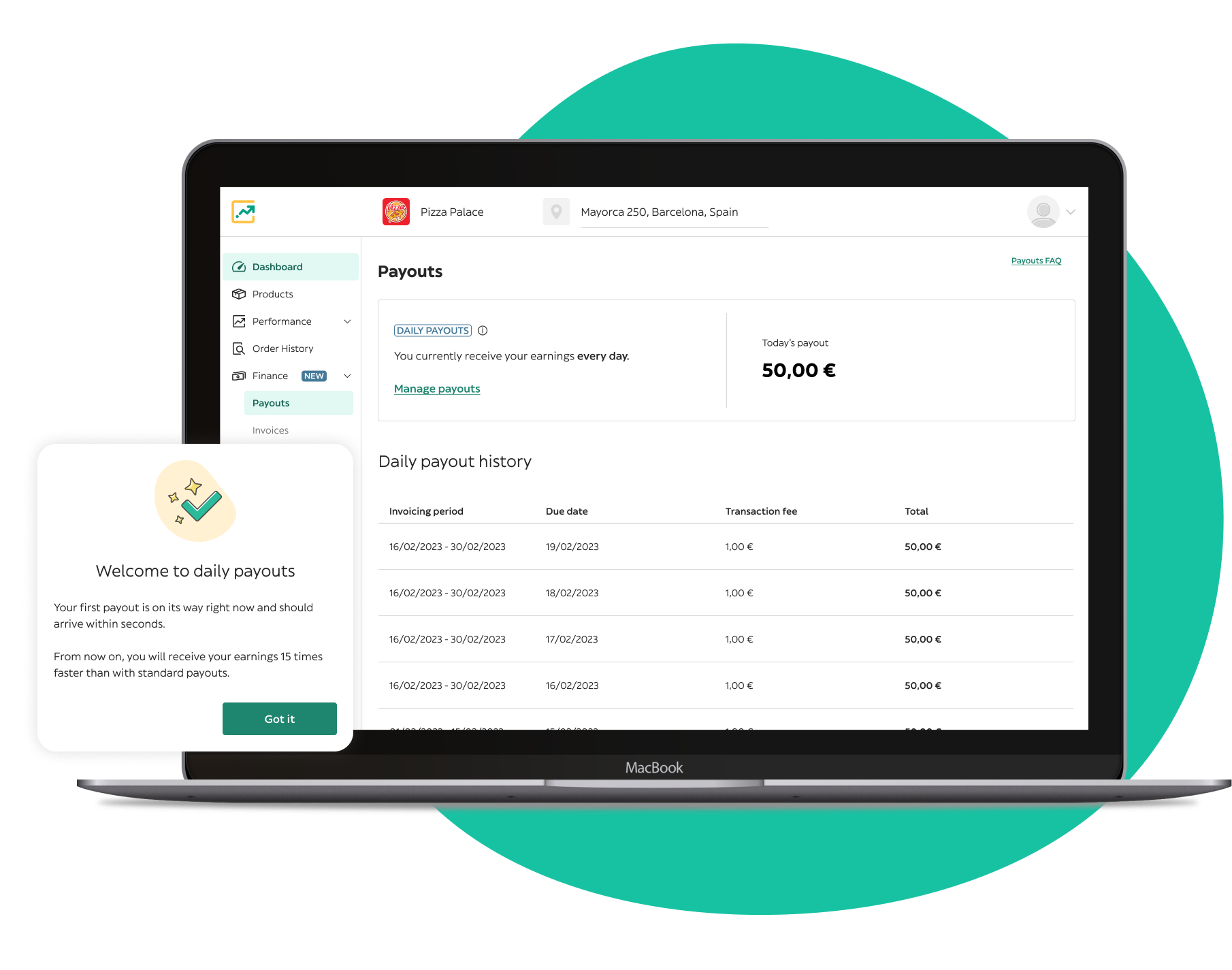

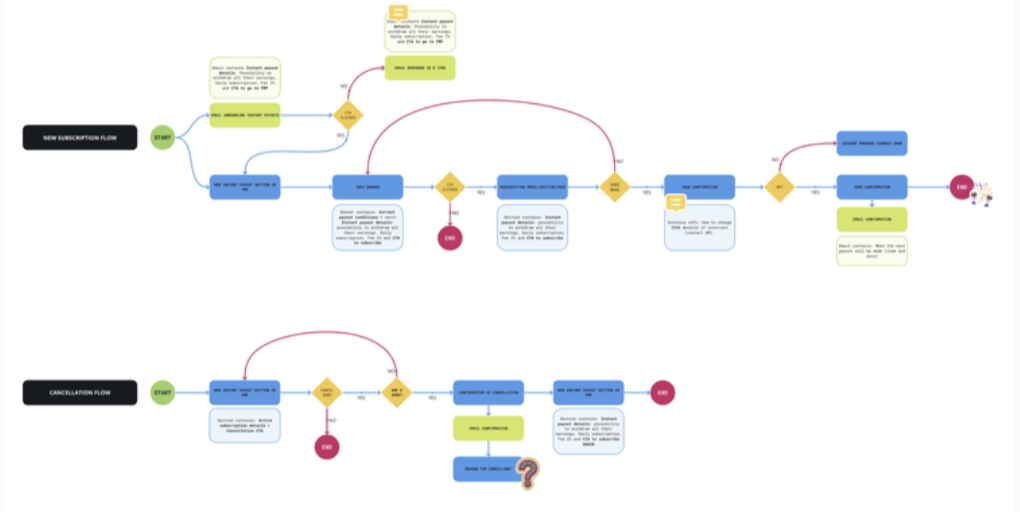

1 · Flow mapping and explorations

We mapped the end-to-end payout journey to understand decision points, trust gaps, payout states and error conditions.

Early trio sessions with PM and Engineering helped define feasibility around eligibility logic, payout timing, and fee display.

The core flow was built around subscribing to Daily Payouts and receiving automatic daily transfers to the partner’s IBAN:

Subscription Flow

A simple, guided opt-in flow explaining:

how Daily Payouts work

the 2% fee

confirmation of bank details for the transfers

The flow minimized friction while reinforcing trust and predictability.

Automatic Daily Transfers

After subscribing, partners received automatic payouts every day, no further manual action required.

Screens focused on:

next payout timing

current status

payout history

Payout History

We added a lightweight history view with:

total amount transferred

fees

status of transaction

This increased transparency and reduced payout-related support interactions

2 · Validation with partners

We tested the prototype with partners to assess overall comprehension with a specific focus on the fee structure, eligibility, timing expectations, and confirmation feedback.

We iterated based on findings, simplifying copy, clarifying hierarchy, and refining success feedback and micro-interactions.

3 · Delivery and QA

We delivered full flow specs, platform guidance, DS component documentation, and error-state content.

We partnered with Engineering and QA to ensure correct acceptance criteria and development.

Impact

Adoption, engagement, and support metrics confirmed strong product–market fit and validated the direction for future iterations.

Quantitative and Qualitative

4% adoption among eligible partners in the pilot, on track for the 8% goal

1,000 partners reached through the initial email campaign

50% email open rate and 8% click-through rate

65€/day average payout per activated partner

Extremely low friction: only 3 users unsubscribed and 2 support tickets were generated

Partners described Daily Payouts as “transparent”, “less uncertain and more predictable” and they highlighted improved financial control.

Business Impact

Daily Payouts strengthened marketplace liquidity, increased partner trust, and validated a sustainable monetization model through the payout fee.

Based on early adoption trends, the feature unlocked a projected 5.4M€/year revenue opportunity for Glovo while maintaining very low operational and fraud risk.

Next steps

Pricing Experiment

Because of the sensibility towards the 2% transaction fee, our next step is to run an A/B test exploring:

alternative pricing models

different communication strategies

clarity improvements around fee explanations

The goal is to identify a fee structure that increases adoption without compromising revenue or operational risk.

Full Launch (V1)

Several improvements were intentionally deferred from the MVP to keep the scope lean.

More flexible payout architecture: To support additional payout frequencies

Enrich payout history: To support additional payout frequencies and offer more detailed tracking for Daily Payouts.

Improve earnings transparency: To offer further details of how the earnings are calculated (platform cost, ads, transactions, etc)

Content Design Intern

To further refine messaging, we plan to replace our Content Design Intern. My cat didn’t do the excellent job this project deserved as he kept stepping on the keyboard 😸

Learnings and Reflections

Pricing and communication are inseparable: adoption depends as much on how fees are explained as on the fee itself.

Aligning early with Finance, Risk, and Engineering was essential given that constraints shaped the solution as much as partner needs.

Starting with a narrow MVP enabled safe experimentation and fast learning without exposing the business to operational or fraud risk.

Mixed-method research (quant + qual) provided the nuance we needed: data revealed adoption barriers, while interviews clarified motivations and expectations.

Weekly trio rituals and early prototype testing reduced rework, kept everyone aligned, and accelerated decision-making across teams.

Overall, this project strengthened my ability to design trustworthy financial flows that balance user needs, business value, and operational safety.

Daily Payouts: A simple, transparent experience that gives partners control over their earnings while reinforcing trust through clear communication and predictable outcomes.